Crapo: Democrats are Proposing More Taxes, More Spending, Higher Prices, and an Army of IRS Agents

Urges colleagues to reject reckless tax-and-spend bill

Washington, D.C.--U.S. Senator Mike Crapo (R-Idaho), Ranking Member of the Senate Finance Committee, delivered remarks on the Democrats’ reckless tax-and-spending bill, outlining what Americans can expect from the mislabeled Inflation Reduction Act of 2022: more taxes, more spending, higher prices, and an army of IRS auditors.

“It’s too many taxes, too much spending, too big of a burden on American people across all income categories.”

To watch Crapo’s full remarks, click HERE or the image above.

On the state of the economy:

The nonpartisan Penn Wharton Budget Model says the “Inflation Reduction Act” will, if anything, raise inflation in the first few years, with a small and insignificant negative effect later in this decade. That same model concludes that there is “low confidence that the legislation will have any impact on inflation.”

But it does have an impact on all of us and our economy.

The bill does nothing to bring the economy out of stagnation and recession. Rather, the “Inflation Reduction Act of 2022” gives us higher taxes, more spending, higher prices, and an army of IRS agents.

On tax hikes:

Hundreds of billions of dollars raised through taxes–around $350 to $400 billion. There’s a new book minimum tax on corporations; a new tax on stock buybacks…

There’s—believe it or not—a new tax on gasoline, on oil and gas and refineries at the very time when our President has shut down production of oil and gas on our interior and offshore, and has stopped the Keystone XL pipeline, basically freezing America’s production and driving us from a state of energy independence to a state of energy dependence, where we have to ask our friends and often our enemies across the globe to increase their gas production to help us deal with our prices at the pump.

Everyone in America knows that corporations don’t bear the burden of the taxes we put on them. Who does? Workers, consumers and owners.

My colleagues are quick to say this is just rich people and rich companies who are “tax cheats.” But the owners of the corporations are primarily people in America who have retired and are leaning on a pension, or who have not yet retired or are trying to save money for retirement by putting their money into 401(k)s or other investment programs.

That’s who bears the burden of these taxes.

On the costs of the bill outweighing purported benefits:

In response to this data that we’ve been able to show about the very tax proposals in this bill the Democrats surprisingly have claimed that this Joint Tax Committee analysis isn’t valid because it didn’t include the effects of their spending that they were putting into the bill.

Well that’s a novel idea—it’s okay to raise taxes and it’s okay to put more tax burden on people making less than $400,000 because we’re going to be sending some subsidies to some of them.

So, we asked the JCT to include those subsidies in its analysis.

The analysis that incorporated the Obamacare subsidies shows that burdens of the proposed tax increases in the Democrats’ reckless bill would be so substantial and so widespread throughout all income categories—I repeat, all income categories—that no amount of temporary health care credits, or subsidies for $80,000 luxury SUVs, will overcome the tax increase burdens that would be overwhelmingly felt by lower- and middle-income Americans.

On prescription drug price controls:

The largest source of proposed savings in the Democrats’ bill is a system of bureaucratic drug price controls that will lead to higher launch prices, stifle growth, gut domestic manufacturing jobs and aid foreign adversaries, like China.

Senate Republicans have developed a commonsense alternative, based on more than two dozen solutions aimed at providing relief at the pharmacy counter while ensuring long-term access to life-saving new treatments and cures.

These are the kinds of solutions that our prescriptions drug pricing system requires, not an arbitrary and offensive federal price-fixing program.

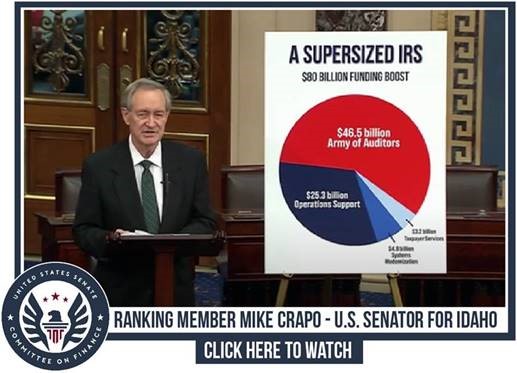

On plans to supersize the IRS:

This bill proposes $80 billion in mandatory appropriations to the IRS. Let me give you a little perspective—the annual budget of the IRS is only about $12.6 billion. Nearly six times the annual budget of the current IRS. Of this, $45.6 billion is for enforcement purposes. That’s more than 57 percent, almost 60 percent of this $80 billion is for enforcement purposes.

Some estimate the $46 billion for an army of auditors may allow the IRS to hire as many as 87,000 new agents. That would make the IRS one of the largest federal agencies--larger than the Pentagon, State Department, FBI, and Border Patrol combined.

…

Multiple studies show that in order to raise the money they are requiring to be raised under this bill, around $200 billion of more tax revenue from Americans by auditing them, they have nowhere else to look.

…

In response to this criticism, they included a sentence that said, “nothing in this bill is ‘intended’--focus on that word, nothing in this bill is “intended”—to increase taxes on those making less than $400,000.”

Why did they use the word “intended”? Because they know that’s not what they want to happen, but it’s what will have to happen, and they are not willing to use a stronger word.

I have asked them, and I will ask them in an amendment on this Floor, to say that “none of this money can be used to audit taxpayers making less than $400,000 a year.”

Let’s see how they vote on that amendment.

____________________________________________________________

Remarks as prepared for delivery:

I’d like to start by going back to near the beginning of this Congress when we were debating what was called “The American Rescue Plan.”

We were told then by our colleagues on the other side that this was going to “save the country.” $1.9 trillion of debt-financed spending they said was going to fix everybody’s concerns in the United States.

Where are we today? 9.1 percent consumer price inflation, which we told them was coming. Gas prices doubling. Economic stagnation: GDP contracted by 0.9 percent in the second quarter, and we’re now arguing over semantics about what defines a recession. 65 percent of the country already think we are in a recession, and more than 80 percent of the country think our economy is on the wrong track.

The nonpartisan Penn Wharton Budget Model says the “Inflation Reduction Act” will, if anything, raise inflation in the first few years, with a small and insignificant negative effect later in this decade.

That same model concludes that there is “low confidence that the legislation will have any impact on inflation.”

But it does have an impact on all of us and our economy.

The bill does nothing to bring the economy out of stagnation and recession. Rather, the “Inflation Reduction Act of 2022” gives us higher taxes, more spending, higher prices, and an army of IRS agents.

HIGHER TAXES

Let’s talk about the taxes first.

Hundreds of billions of dollars raised through taxes—around $350 to $400 billion.

There’s a new book minimum tax on corporations; a new tax on stock buybacks;

There’s—believe this or not—a new tax on gasoline, on oil and gas and refineries at the very time when our President has shut down production of oil and gas on our interior and offshore, and has stopped the Keystone XL pipeline, basically freezing America’s production and driving us from a state of energy independence to a state of energy dependence, where we have to ask our friends and often our enemies across the globe to increase their gas production to help us deal with our prices at the pump.

And this book minimum tax—everyone in America knows that corporations don’t bear the burden of the taxes we put on them. Who does? Workers, consumers and owners.

A recent National Bureau of Economic Research study estimates 31 percent is borne by consumers via price hikes at a time when we’re dealing with record inflation; 38 percent is borne by workers via lower wages, or less employment; and 31 percent is borne by owners.

My colleagues are quick to say this is just rich people and rich companies who are “tax cheats.” But the owners of the corporations are primarily people in America who have retired and are leaning on a pension, or who have not yet retired or are trying to save money for retirement by putting their money into 401(k)s or other investment programs.

That’s who bears the burden of these taxes.

We asked the nonpartisan Joint Committee on Taxation (JCT) to tell us who will bear the burden of these tax hikes. They told us that in 2023, taxes will increase by $16.7 billion on American taxpayers earning less than $200,000. Another $14.1 billion would come from taxpayers earning between $200,000 and $500,000.

By 2031, when the new green energy credits and subsidies provide an even greater benefit to those with higher incomes, those earning below $400,000 are projected to bear as much as two-thirds of the burden of the additional tax revenue collected that year.

That’s what we’re being offered as a solution to the crisis that we are now facing in our economy.

And, as I’ll discuss later, the nonpartisan Congressional Budget Office has recently confirmed that a significant portion of revenue that the IRS supersized funding Democrats claim will be forthcoming comes from audits that will squeeze tens of billions out of taxpayers earning less than $400,000.

So, in response to this data that we’ve been able to show about the very tax proposals in this bill the Democrats surprisingly have claimed that this Joint Tax Committee analysis isn’t valid because it didn’t include the effects of their spending that they were putting into the bill.

Well that’s a novel idea—it’s okay to raise taxes and it’s okay to put more tax burden on people making less than $400,000 because we’re going to be sending some subsidies to some of them.

So, we asked the JCT to include those subsidies in its analysis, which they did.

The analysis that incorporated the Obamacare subsidies shows that burdens of the proposed tax increases in the Democrats’ reckless bill would be so substantial and so widespread throughout all income categories—I repeat, all income categories--that no amount of temporary health care credits, or subsidies for $80,000 luxury SUVs, will overcome the tax increase burdens that would be overwhelmingly felt by lower- and middle-income Americans.

Few, if any, Americans will get a net reduction in their tax burden. And for any that do, it will only be temporary. The vast majority will still bear the burden of these taxes.

Book Minimum Tax

The book minimum tax does not close loopholes—it raises taxes on U.S. companies by hundreds of billions of dollars.

And, it would not prevent all companies from paying zero tax. Instead, it would let some of the companies preferred by the Democrats continue to avoid their taxes by using—not loopholes—but legitimate provisions for R&D and other kinds of tax credits that are intended to incentivize the conduct of those companies.

JCT has already estimated that half of the burden of the book minimum tax would fall on manufacturers.

In other words, as 252 trade associations and chambers of commerce from across the country said when they realized that close to half this burden would fall on manufacturers:

“Enacting the proposed Corporate Book Minimum Tax would be the antithesis of sound tax policy and administration. Its introduction would be neither simple nor administrable and would pose a competitive disadvantage to U.S.-headquartered businesses while increasing the incidence of unrelieved double taxation. It would also have a detrimental effect on the quality of financial reporting.”

The Business Roundtable said:

“[T]he proposed book minimum tax would, among other things, suppress domestic investment when increased investment is needed to spur a strong recovery. This tax hike would also undermine the competitiveness of America’s exporters.

Even with a carve-out for accelerated depreciation, there remain many unresolved problems within the design and structure of the minimum tax that make it a poor revenue option.

Stock Buybacks

Let’s go to the next tax they raise: stock buybacks.

Once again, my colleagues on the other side are quick to attack any company that does a stock buyback, saying they’re trying to make owners of their stock who are “rich tax cheaters” even more wealthy.

I’ve already explained that the owners of that stock are the vast majority of Americans who are retired, working toward retirement or who are trying to invest a little bit to get ahead.

Despite Democrats’ claim that they are only closing loopholes, they are doubling down and proposing a new $74 billion tax increase on U.S. companies.

Democrats want to create a third layer of tax on American companies, which will have the harshest impact on seniors and other savers.

The WSJ in a recent editorial explained:

“Companies use buybacks to return cash to shareholders for which they don’t have a better use. Shareholders who sell shares back to the company can invest the proceeds elsewhere. That beats letting the cash sit on corporate books earning interest while CEOs get complacent or decide to buy a business they don’t understand how to run.

“Buybacks aren’t tax free: Owners who sell shares back to the company realize a taxable capital gain. Any boost in the share price contributes to a higher taxable gain for remaining owners when they sell their shares in the future.

“Why not pay dividends instead? Companies and shareholders might prefer buybacks in some instances, such as if the company is disbursing a one-time lump sum or shifting the balance of equity and debt on its books. For the economy overall, buybacks have the effect of distributing capital specifically to those owners who choose to participate because they believe they have a more productive use for it. Capital flows from companies that don’t need it to companies that do.

Democrats are telling companies, if you return value to your retirees or to 401(k) plans or to pension plans, then you will pay a punitive tax.

The majority of American households have direct or indirect ownership of corporate stock via pensions, 401(k)s, or other savings vehicles. Eighty to 100 million Americans have a 401(k). 46.4 million households have an individual retirement account. Half of Generation-Zers and Millennials are invested in stocks.

Seniors are especially dependent on investment income.

An Association of Mature American Citizens report shows that 68 percent of workers between the ages of 55-64 were active participants in a retirement plan to save for their golden years, and that on average 40 percent of seniors’ net worth is held in stocks and mutual funds invested over and above those retirement accounts.

Companies also rely on investments by individuals and institutions like pension funds to finance their operations.

Successful companies use this capital to generate profits, which are then used for expansion, research and development, hiring and benefits, and investment in communities. Companies may also choose to pay down debt or return excess funds to shareholders

Restricting stock buybacks could force companies to sit on cash or waste it on low-potential projects--both of which limit our economic growth and prosperity.

As the Tax Foundation points out:

“A large body of evidence supports the idea that companies generally only consider stock buybacks when they have exhausted their investment opportunities and met their other obligations, meaning it is residual cash flow that is used for buybacks. In fact, stock buybacks can supplement capital investments, as they can help reallocate capital from old, established firms to new and innovative firms.”

This unvetted stock buybacks tax is a crippling tax that reduces retirement security for Americans.

Tax on American Energy

Let’s go to the next tax they propose, and this one is a little difficult to understand—the Superfund tax and methane fee.

I understand why they call it the Superfund tax—it’s a 16.4 percent increase on oil and gas production in the United States.

According to the Energy Information Agency, regular gasoline prices have risen $1.94 per gallon since President Biden was inaugurated, an increase of more than 80 percent.

Americans are still paying, on average, more than $4.00 for a gallon of gas, and many can still remember the more-than-$5.00/gallon. The price for utility gas service is up by almost 40 percent.

These price increases occurred because President Biden shut down domestic energy production, including through permitting delays and canceling the Keystone XL pipeline.

Now, unbelievably, the President’s Democrat allies in Congress are doubling down with a methane tax and higher royalties on petroleum.

Re-imposing and increasing by nearly 70 percent the Superfund tax on refiners of crude oil, importers of petroleum products, and crude oil exporters, costing almost $12 billion over ten years--which will ultimately be borne by American motorists.

In addition, higher taxes diminish the ability to improve domestic supplies of oil by making capital investments cost prohibitive at a time when the U.S. has already lost one million barrels per day of refining capacity compared to before the pandemic.

On the methane fee, the American Gas Association says:

“New fees or taxes on energy companies will raise costs for customers, creating a burden that will fall most heavily on lower-income Americans…. [B]ased on similar proposals introduced earlier this Congress, we estimate that the fee could amount to tens of billions of dollars annually. These major new costs most likely will result in higher bills for natural gas customers, including families, small businesses, and power generators…. Any increase in low-income households’ energy costs could prove devastating.”

The bottom line on taxes is that millions of Americans will bear the burden of these tax hikes.

Some of my colleagues have claimed that those tax hikes are worth the supposed benefit. Let’s look at the benefits:

DRUG PRICE REFORM

The largest source of proposed savings in the Democrats’ bill is a system of bureaucratic drug price controls that will lead to higher launch prices, stifle growth, gut domestic manufacturing jobs and aid foreign adversaries, like China.

These proposals will lead to:

Higher launch prices for new medications, triggering financial strain at the pharmacy counter, as confirmed by the Congressional Budget Office.

Hundreds of thousands of American job losses, particularly in domestic manufacturing--which is already getting hit by the new book minimum tax--with some estimates projecting as many as 800,000.

A competitive edge for the Chinese Communist Party, which has singled out biomedical innovation as a pillar of its industrial policy strategy, and which could ultimately supplant the U.S. as the global life sciences leader, with profound national security implications.

An unprecedented expansion of the D.C. federal health bureaucracy, financed with a staggering $3 billion in new administrative spending. This bureaucracy would also have unbridled new government price-setting authorities—with permanent prohibitions on judicial and administrative review, and with initial implementation shielded from basic notice-and-comment rulemaking requirements.

Fewer new treatments and cures, with a University of Chicago analysis estimating 135 fewer new drugs approved between now and 2039, resulting from an 18.5 percent reduction in innovative research and development.

Less funding for cancer R&D: Today, nearly 50 percent of the FDA pipeline is comprised of new cancer treatments. However, according to the same economists at University of Chicago, the drug price controls would reduce funding for cancer R&D by nearly $18.1 billion, or over nine times the amount of funding proposed for President Biden’s Cancer Moonshot. So much for the President’s “cancer moonshot.”

Dangerous new mechanisms for compelling total compliance with federal government mandates, with potential applications across all sectors of the economy, including:

An escalating non-compliance penalty of up to 95 percent of all gross sales—levied every day—for failure to meet any terms of the government price-setting program (“negotiation” in name only), rendering any new federal mandate—however sweeping—an offer you can’t refuse. Even late paperwork would trigger this crippling, catastrophic penalty, which has a tax-exclusive rate of up to 1,900 percent.

As a messaging gimmick, Democrats have framed their government price-setting program as “negotiation,” but their legislation tells a far different story. Under their proposed program:

The Secretary has absolute, unilateral, uninhibited price-setting authority—with no floor—enabling a price of $1 for even the most innovative new drugs.

Manufacturers have no choice but to comply and to provide indefinite access to their products at the Secretary-dictated price, regardless of how unfair. They cannot walk away from the “negotiating table” or withdraw selected products from the Medicare market, even if the Secretary sets an economically untenable price, stripping even small businesses of any leverage.

Judicial and administrative review of key decisions—including the price-setting itself—are permanently prohibited.

The bill completely disregards the rest of the prescription drug supply chain, targeting manufacturers while doing nothing to address other key players or to improve oversight and transparency.

Senate Republicans have developed a commonsense alternative, based on more than two dozen solutions aimed at providing relief at the pharmacy counter while ensuring long-term access to life-saving new treatments and cures.

Among other provisions, virtually all of which are based on proposals with bipartisan support, the Lower Costs, More Cures Act (S. 2164) would:

Reform the Part D benefit to reduce seniors’ cost-sharing burden and incentivize plans to negotiate the best deals possible for enrollees.

Create a hard cap on annual out-of-pocket spending for all seniors under Medicare Part D.

Increase Part D plan choices for seniors by enabling sponsors to offer additional plans, with incentives for options that pass a greater share of discounts directly to beneficiaries at the pharmacy counter.

Permanently extend a Trump Administration program providing Part D enrollees with access to plan options that cap out-of-pocket monthly insulin costs at $35 or less.

Permanently allow high-deductible health plans to offer pre-deductible coverage for preventive services, including insulin.

Establish a Chief Pharmaceutical Negotiator to combat foreign freeloading, ensuring the best trade deals achievable for American consumers and job creators.

Strengthen consumer-oriented oversight through more useful cost comparison tools, price transparency measures, and robust reporting requirements for stakeholders across the drug supply chain, including pharmacy benefit managers.

Facilitate value-based arrangements, where private and public-sector payers can pay based on patient outcomes, driving better results for patients at a lower cost.

Restructure payments for drugs administered in the doctor’s office or hospital outpatient department to encourage physicians to deliver cost-effective treatment options, when clinically appropriate.

These are the kinds of solutions that our prescriptions drug pricing system requires, not an arbitrary and offensive federal price-fixing program.

IRS Funding for an Army of Auditors

This bill proposes $80 billion in mandatory appropriations to the IRS.

Let me give you a little perspective – the annual budget of the IRS is only about $12.6 billion. Nearly six times the annual budget of the current IRS. Of this, $45.6 billion for enforcement purposes. That’s more than 57 percent, almost 60 percent of this $80 billion is for enforcement purposes. $25.3 billion is for operations support. Only $4.8 billion for business systems and bringing themselves into the 21st century so they can communicate with taxpayers; and $3.2 billion for taxpayer services, or 4 percent.

Some estimate the $46 billion for an army of auditors may allow the IRS to hire as many as 87,000 new agents.

That would make the IRS one of the largest federal agencies--larger than the Pentagon, State Department, FBI, and Border Patrol combined.

According to the Congressional Research Service, the Democrats’ reckless IRS funding increase would raise enforcement funding by nearly 70 percent above what IRS is currently projected to get.

Increased audits for the middle class, small businesses, and those making less than $400,000 are inevitable and unavoidable under this Act.

How will the $45.6 billion for enforcement purposes be used?

Interestingly, the White House and even the IRS Commissioner have said “they won’t use all this money for auditing people who make less than $400,000.” My colleagues just continue to say they won’t do it.

Multiple studies show, however, that in order to raise the money they are requiring to be raised under this bill, around $200 billion of more tax revenue from Americans by auditing them, they have nowhere else to look.

Last year, the IRS announced that it planned to ramp up audits of small businesses by 50 percent this year.

Why did they announce that? Because that’s where they need to look to collect all of this new tax revenue that they want to get.

I asked the nonpartisan Joint Committee on Taxation to estimate where the most underreported income in the “tax gap” lies—where the supposed revenue would come from, that my colleagues on the other side say comes from “big tax cheats.”

JCT looked at IRS data and determined out of all the revenue projected to be raised from underreported income: 40-57 percent could come from taxpayers making $50,000 or less; 65-78 percent from those making less than $100,000; and 78-90 percent from those making less than $200,000. Only around 4-9 percent could come from those making $500,000 or more.

That’s what the data shows. That’s why the IRS amounted a 50 percent increase in audits for small businesses, and that’s why it is impossible for the Democrats’ claims that they don’t want to have audits of people under $400,000, cannot be honored.

You know, in their bill, in response to this criticism, they included a sentence that said, nothing in this bill is ‘intended’--focus on that word, nothing in this bill is ‘intended’--to increase taxes on those making less than $400,000.

Why did they use the word ‘intended’? Because they know that’s not what they want to happen, but it’s what will have to happen, and they are not willing to use a stronger word.

I have asked them, and I will ask them in an amendment on this floor, to say that “none of this money can be used to audit taxpayers making less than $400,000 a year.”

Let’s see how they vote on that amendment.

Why couldn’t they just say that this money ‘shall not’ increase taxes on people earning less than $400,000 per year? Why couldn’t they say that these funds cannot be utilized to audit taxpayers making less than $400,000 per year?

Because they know they can’t say that and claim the amount of revenue they want to spend, unless they audit those making less than $400,000 per year.

The fact is the “tax gap” isn’t just millionaires, billionaires, oligarchs, or whatever the term-of-the-attack is today.

To say that everyone who has misreported their income as “tax cheats” is misdirection. It calls all of these people who make less than $400,000 who are simply having trouble complying with this complex internal revenue code a “tax cheat,” and that’s unfair.

We examined the IRS’s own data on how successful it is in having the courts sustain its claims that these folks in the $400,000 category and other categories are cheating on their taxes.

Over the past twenty years, the IRS has a less-than 47 percent success rate, and a less-than 45 percent success rate over the last ten years.

In other words, the IRS more often asserts these tax deficiencies exist than the courts agree with. That is hardly evidence for a multitude of tax cheats, but firm evidence that innocent taxpayers are often subjected to unnecessary and inappropriate scrutiny.

And we can be sure they will be with 87,000 new auditors.

Again, making the IRS larger than all of those other agencies that I talked about.

And by the way, folks may remember, just a short time back when the proposal also included language that would let the IRS get into the bank accounts and monitor the transactions of deposits and withdrawals of all Americans who have more than $10,000 worth of transactions in a year. Which is, essentially, almost all Americans

Admittedly, that language isn’t in this bill, yet, but the broad authority that is given to the Internal Revenue Service with this $80 billion of supersizing will undoubtably result in rules and regulations issued by the IRS to achieve that objective. They know they couldn’t put it in statute, because it would be rejected, immediately, by the American people.

I encourage the American people to see past this and to reject this legislation.

It’s too many taxes, too much spending, too big of a burden on American people across all income categories.

We don’t want to supersize the Internal Revenue Service.

Going back to that very first statistic I gave you—this bill isn’t even going to have a statistically significant impact on inflation. If anything, the taxes will drive prices up.

Madame President, I encourage all of my colleagues to reject this reckless bill.

###